Brief History of Insurance in India

Brief History of Insurance in India

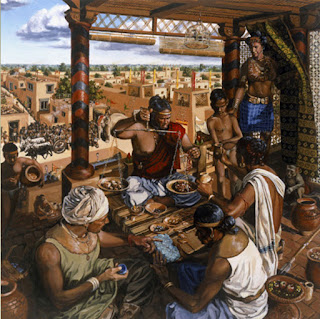

In India,

insurance has a deep-rooted history. It finds mention in the writings of Manu

( Manusmrithi ), Yagnavalkya ( Dharmasastra )

and Kautilya ( Arthasastra ). The writings talk in terms of

pooling of resources that could be re-distributed in times of calamities such

as fire, floods, epidemics and famine. This was probably a pre-cursor to modern

day insurance. Ancient Indian history has preserved the earliest traces of

insurance in the form of marine trade loans and carriers’ contracts. Insurance

in India has evolved over time heavily drawing from other countries, England in

particular.

1818 saw the advent of life

insurance business in India with the establishment of the

Oriental Life Insurance Company in Calcutta. This Company however failed in

1834. In 1829, the Madras Equitable had begun transacting life insurance

business in the Madras Presidency. 1870 saw the enactment of the British

Insurance Act and in the last three decades of the nineteenth century, the

Bombay Mutual (1871), Oriental (1874) and Empire of India (1897) were started

in the Bombay Residency. This era, however, was dominated by foreign insurance

offices which did good business in India, namely Albert Life Assurance, Royal

Insurance, Liverpool and London Globe Insurance and the Indian offices were up

for hard competition from the foreign companies.

In 1914, the Government of India started publishing returns of Insurance

Companies in India. The Indian Life Assurance Companies Act, 1912 was the

first statutory measure to regulate life business. In 1928, the Indian

Insurance Companies Act was enacted to enable the Government to collect

statistical information about both life and non-life business transacted in

India by Indian and foreign insurers including provident insurance societies.

In 1938, with a view to protecting the interest of the Insurance public, the

earlier legislation was consolidated and amended by the Insurance Act, 1938

with comprehensive provisions for effective control over the activities of

insurers.

The Insurance Amendment Act of 1950 abolished Principal Agencies. However,

there were a large number of insurance companies and the level of competition

was high. There were also allegations of unfair trade practices. The Government

of India, therefore, decided to nationalize insurance business.

An Ordinance was issued on 19th January, 1956 nationalising

the Life Insurance sector and Life Insurance Corporation came into existence in

the same year. The LIC absorbed 154 Indian, 16 non-Indian insurers as also 75

provident societies—245 Indian and foreign insurers in all. The LIC had

monopoly till the late 90s when the Insurance sector was reopened to the

private sector.

The history of general insurance

dates back to the Industrial Revolution in the west and the

consequent growth of sea-faring trade and commerce in the 17th century.

It came to India as a legacy of British occupation. General Insurance

in India has its roots in the establishment of Triton Insurance Company Ltd.,

in the year 1850 in Calcutta by the British. In 1907, the Indian Mercantile

Insurance Ltd was set up. This was the first company to transact all classes of

general insurance business.

1957

saw the formation of the General Insurance Council, a wing of the Insurance

Association of India. The General Insurance Council framed a code of conduct

for ensuring fair conduct and sound business practices.

In 1968, the Insurance Act was amended to regulate investments and set minimum

solvency margins. The Tariff Advisory Committee was also set up then.

In 1972 with the passing of the General Insurance Business (Nationalisation)

Act, general insurance business was nationalized with effect from 1st January,

1973. 107 insurers were amalgamated and grouped into four companies,

namely National Insurance Company Ltd., the New India Assurance Company Ltd.,

the Oriental Insurance Company Ltd and the United India Insurance Company Ltd.

The General Insurance Corporation of India was incorporated as a company in

1971 and it commence business on January 1st 1973.

This millennium has seen insurance come a full circle in a journey extending to

nearly 200 years. The process of re-opening

of the sector had begun in the early 1990s and the last decade

and more has seen it been opened up substantially. In 1993, the Government set

up a committee under the chairmanship of RN Malhotra, former Governor of

RBI, to propose recommendations for reforms in the insurance sector. The

objective was to complement the reforms initiated in the financial

sector. The committee submitted its report in 1994 wherein, among other

things, it recommended that the private sector be permitted to enter the

insurance industry. They stated that foreign companies be allowed to enter by

floating Indian companies, preferably a joint venture with Indian partners.

Following the recommendations of the Malhotra Committee report, in 1999, the

Insurance Regulatory and Development Authority (IRDA) was constituted as an

autonomous body to regulate and develop the insurance industry. The IRDA was

incorporated as a statutory body in April, 2000. The key objectives of the IRDA

include promotion of competition so as to enhance customer satisfaction through

increased consumer choice and lower premiums, while ensuring the financial

security of the insurance market.

The IRDA opened up the market in August 2000 with the invitation for

application for registrations. Foreign companies were allowed ownership of up

to 26%. The Authority has the power to frame regulations under Section 114A of

the Insurance Act, 1938 and has from 2000 on wards framed various regulations

ranging from registration of companies for carrying on insurance business to

protection of policyholders’ interests.

In December, 2000, the subsidiaries of the General Insurance Corporation

of India were restructured as independent companies and at the same time

GIC was converted into a national re-insurer. Parliament passed a bill

de-linking the four subsidiaries from GIC in July, 2002.

Today there are 31 general insurance companies including the ECGC and

Agriculture Insurance Corporation of India and 24 life insurance companies

operating in the country.

The insurance sector is a colossal

one and is growing at a speedy rate of 15-20%. Together with

banking services, insurance services add about 7% to the country’s GDP. A

well-developed and evolved insurance sector is a boon for economic development

as it provides long- term funds for infrastructure development at the same time

strengthening the risk taking ability of the country

The I.R.D.A. was established to

regulate, promote and ensure orderly growth of Life and General Insurance

Industry in India. The Authority consists of following members.

·

A

Chairperson

·

Not more

than five whole-time members.

·

Not more

than four part time members.

The members would be appointed by

the Central Government. The IRDA is a Corporate Body.

It is advised by an Insurance

Advisory Committee consisting of not more than 25 members representing

industry, commerce, transport and consumer forum etc,

Presently there are 24 Life

Insurance Companies, 25 General Insurance Companies and 6 Health

Insurance Companies doing business in India as detailed below:-

Life Insurance

Companies are:-

S No

|

Name of Life Insurance Companies

|

1

|

Bajaj Allianz Life Insurance Co. Ltd.

|

2

|

Birla Sun Life Insurance Co. Ltd

|

3

|

HDFC Standard Life Insurance Co. Ltd

|

4

|

ICICI Prudential Life Insurance Co. Ltd

|

5

|

Exide Life Insurance Co. Ltd.

|

6

|

Life Insurance Corporation of India

|

7

|

Max Life Insurance Co. Ltd

|

8

|

PNB Metlife India Insurance Co. Ltd.

|

9

|

Kotak Mahindra Old Mutual Life Insurance Co. Ltd

|

10

|

SBI Life Insurance Co. Ltd

|

11

|

TATA AIA Life Insurance Co. Ltd.

|

12

|

Reliance Nippon Life Insurance Co. Ltd.

|

13

|

Aviva Life Insurance Company India Limited

|

14

|

Sahara India Life Insurance Co. Ltd.

|

15

|

Shriram Life Insurance Co. Ltd.

|

16

|

Bharti Axa Life Insurance Co. Ltd.

|

17

|

Future General India Life Insurance Co. Ltd.

|

18

|

IDBI Federal Life Insurance Co. Ltd.

|

19

|

Canara HSBC Oriental Bank Of Commerce Life Insurance Co. Ltd.

|

20

|

AEGON Life Insurance Co. Ltd.

|

21

|

DHFL Pramerica Life Insurance Co. Ltd.

|

22

|

Star Union Dai-Ichi Life Insurance Co. Ltd.

|

23

|

India first Life Insurance Co. Ltd.

|

24

|

EDELWEISS TOKIO Life Insurance Co. Ltd.

|

S No

|

Name of General

Insurance Companies

|

1

|

Bajaj Allianz General Insurance Co. Ltd.

|

2

|

ICICI Lombard General Insurance Co. Ltd.

|

3

|

IFFCO Tokio General Insurance Co. Ltd.

|

4

|

National Insurance Co. Ltd.

|

5

|

The New India Assurance Co. Ltd.

|

6

|

The Oriental Insurance Co. Ltd.

|

7

|

United India Insurance Co. Ltd.

|

8

|

Reliance General Insurance Co. Ltd.

|

9

|

Royal Sundaram General Insurance Co. Limited

|

10

|

TATA AIG General Insurance Co. Ltd.

|

11

|

Cholamandalam Ms General Insurance Co. Ltd.

|

12

|

HDFC ERGO General Insurance Co. Ltd.

|

13

|

Export Credit Guarantee Corporation of India Ltd.

|

14

|

Agriculture Insurance Co. of India Ltd.

|

15

|

Star Health and Allied Insurance Company Limited

|

16

|

Apollo Munich Health Insurance Company Limited

|

17

|

Future General India Insurance Company Limited

|

18

|

Universal Sompo General Insurance Co. Ltd.

|

19

|

Shriram General Insurance Company Limited

|

20

|

Bharti Axa General Insurance Company Limited

|

21

|

Raheja QBE General Insurance Company Limited

|

22

|

SBI General Insurance Company Limited

|

23

|

MAX BUPA Health Insurance Company Ltd.

|

24

|

HDFC General Insurance Company Limited

|

25

|

RELIGARE Health Insurance Company Limited

|

26

|

MAGMA HDI General Insurance Company Limited

|

27

|

liberty Videocon general insurance company limited,

|

28

|

CIGNA TTK Health Insurance Company Ltd.

|

29

|

Kotak Mahindra General Insurance Company Limited

|

30

|

Aditya Birla Health Insurance Co. Limited

|

31

|

DHFL General Insurance Limited

|

D.Bhavani Sankar Reddy

Lecturer in Commerce

Government(A)Collage

Rajamahendravaram.

Comments

Post a Comment